Harley Davidson Financial Analysis

Ten years of annual and quarterly financial ratios and margins for analysis of Harley-Davidson HOG.

Harley davidson financial analysis. The Motorcycles and Related Products segment designs manufactures and sells cruiser and touring motorcycles for the heavyweight market. The Motorcycles Related Products segment and Financial Services. INTRODUCTION This project is one of three reports I will complete as part of the strategic analysis of Harley-Davidson.

Harley-Davidson manufactures heavyweight motorcycles as well as a complete line of parts apparel and accessories for motorcycles. Securities and Exchange Commission SEC. It is currently a public company with over 100years of experienceproducing motorcycles.

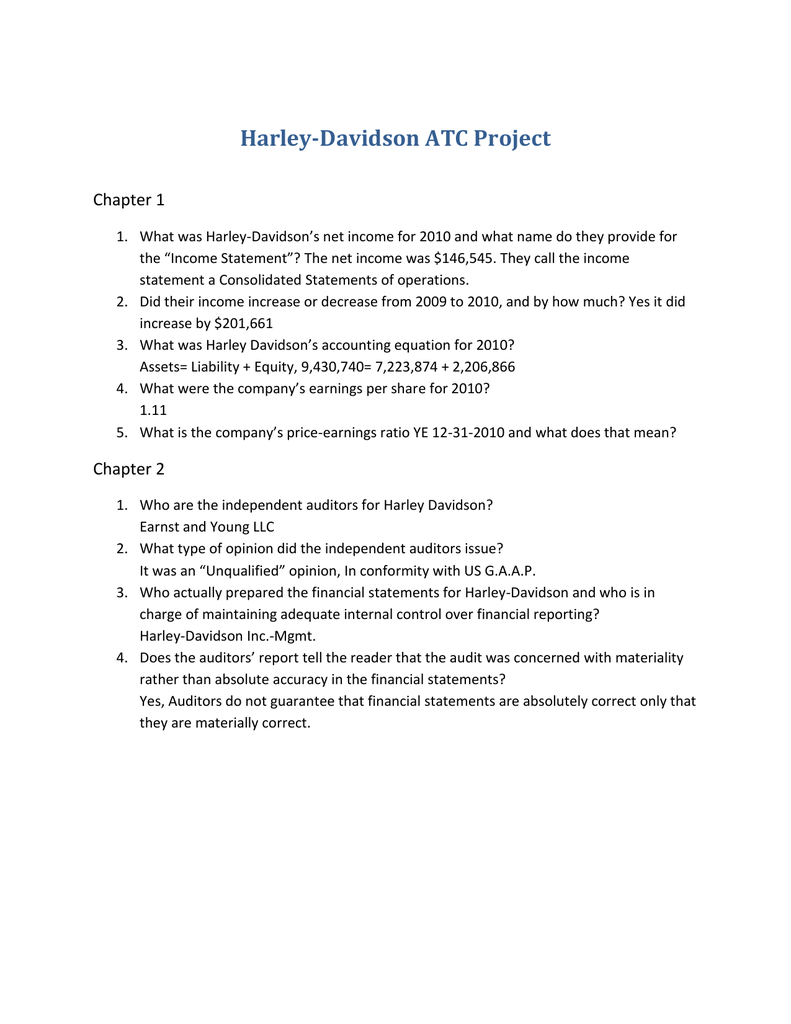

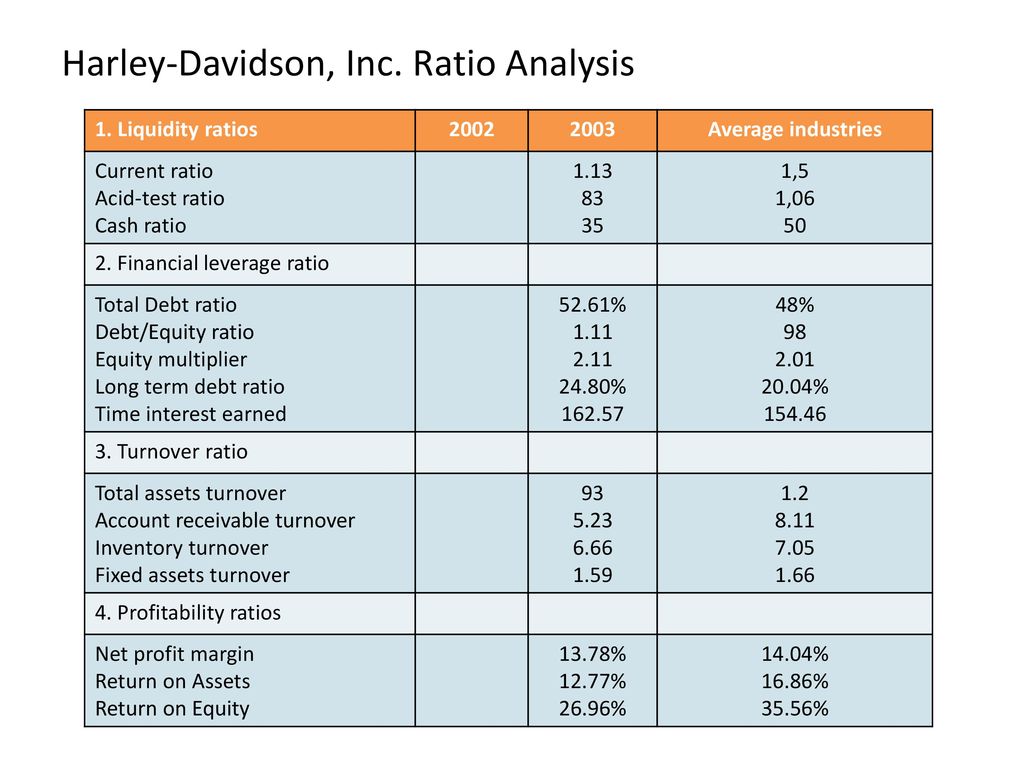

Includes annual quarterly and trailing numbers with full history and charts. Ratio Analysis HARLEY-DAVIDSON FINANCIAL ANALYSIS Harley-Davidson Inc. Is the parents company to companies that form a group and do business as Harley-Davidson Motor Company.

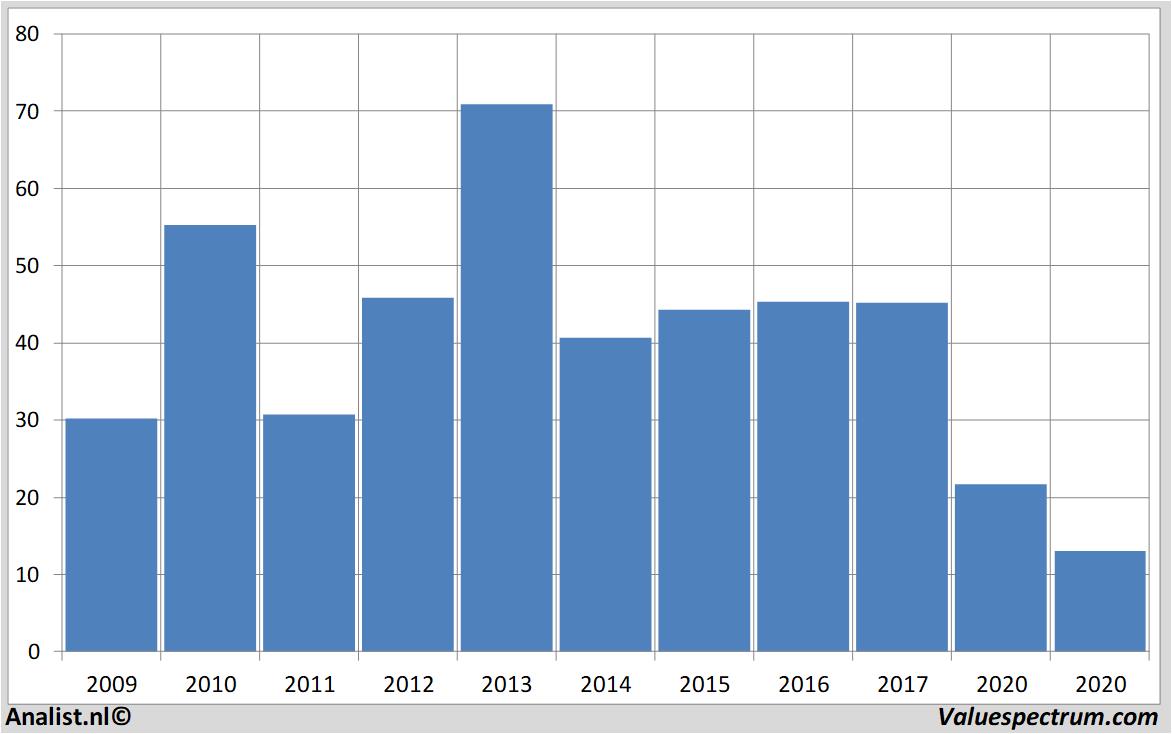

Is lower than its historical 5-year average. Hereafter the Company for the year 2020 submitted to the US. Harley-Davidson designs manufactures and sells heavyweight motorcycles.

This first report focuses on strategy analysis and includes the following sections. The EVEBITDA NTM ratio of Harley-Davidson Inc. Harley Davidson Strategic AuditPresented to.

I hope you enjoy and feel fr. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Harley-Davidson Incs. Internal Analysis Financial Analysis Harley-Davidsons financials are a key component on internally analyzing Harley-Davidson and how well they are performing by.